The question is a matter of life and death: A new disease is sweeping across the country, and epidemiologists project it will claim the lives of 600 people. Scientists have proposed two alternative programs to address the outbreak, and you must decide which to implement.

- If program A is adopted, 200 people will be saved.

- If program B is adopted, there is a one-third probability that 600 people will be saved, but a two-thirds probability that no one will be saved at all.

Which do you choose?

If you selected program A, you’re in good company. When behavioral economics luminaries Amos Tversky and Daniel Kahneman posed this problem to participants in a study, 72 percent elected the first option. Later, with a different group of individuals, Tversky and Kahneman presented the same scenario, an outbreak poised to harm 600 people. This time, however, the options were different:

- If program C is adopted, 400 people will die.

- If program D is adopted, there is a one-third probability that no one will die, but a two-thirds probability that 600 people will die.

In this case, 78 percent of participants chose program D. Did you?

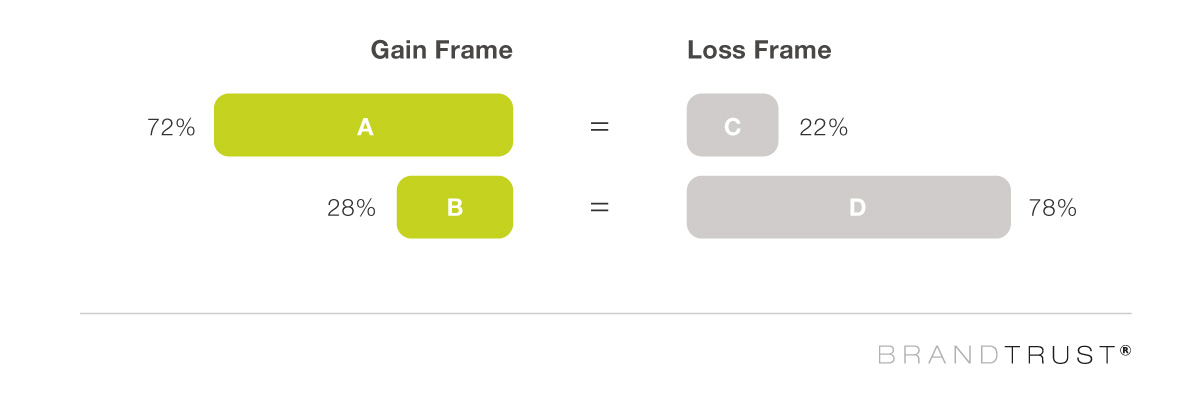

Or perhaps you noticed an interesting feature of Tversky and Kahneman’s experiment: In terms of numerical outcomes, the two choices offered to each set of participants were exactly the same. When faced with an impending loss of 600 lives, saving 200 people and losing 400 people are exactly the same result. So why do 72 percent select this outcome when it as framed as a certain gain, but merely 22 percent choose it when it is described as a certain loss?

An equivalent pattern emerges for programs B and D: In terms of probability and possible outcomes, they are indistinguishable. Just 28 percent will take the one-third chance of saving 600 lives, whereas 78 percent will take the same odds when the option is framed in terms of potential deaths. Why does the prospect of loss increase our appetite for risk, whereas the possibility of gains makes us run from it?

Prospect Theory: Irrationality in Action

Over the course of their illustrious careers, Tversky and Kahneman performed hundreds of experiments of this nature, teasing out seemingly inexplicable patterns in human choice and behavior. Their work became fundamental to the emerging discipline of behavioral economics, which sought to study the dynamics of human evaluation and action as they actually occur.

While Tversky passed away in 1996, Kahneman went on to receive the Nobel Prize in economics for his research in this area. In explaining their selection, the prize committee commended Kahneman “for having integrated insights from psychological research into economic science, especially concerning human judgment and decision-making under uncertainty.”

Kahneman and Tversky developed a term to describe their study of how people make choices when faced with risk: prospect theory. Their contributions in this field were all the more impressive for their bold contrarian approach. Relative to existing notions of how people evaluate probable gains and losses, the prospect theory represented a major departure from conventional wisdom – a bull in the china shop of established economic principles.

Indeed, prior research concerning risk analysis adhered to logical notions of utility: the anticipated enjoyment or desirability inherent in a potential selection. Faced with uncertain outcomes, rational actors weigh potential gains and losses to maximize utility. These utilitarian theories do admit the possibility of variation in human choices – our needs and motives differ. But individuals are understood to possess coherent analytical frameworks, impervious to contextual influence.

Conversely, prospect theory insists that patterns of human choice reflect the framing of alternatives. Notions of utility can’t account for the results of the disease outbreak experiment, in which numerically identical options were assessed in radically different terms. Clearly, the human mind is susceptible to more than logic alone in evaluating gains and losses, and the prospect theory seeks to expose our cognitive biases.

Why should brands concern themselves with the learnings of prospect theory? Because if “human judgment and decision-making under uncertainty” are Kahneman’s areas of expertise, they are also essential focuses for marketers.

When customers choose between competitors, they are actually assessing potential losses and gains. As they consider a new company, consumers confront uncertainty. In a world of relentless global competition among businesses, the prospect theory’s implications are too important to ignore.

At Brandtrust, our team strives to bring the interrogative spirit of prospect theory to bear on all our endeavors. Working with admired brands around the country, we urge our clients to engage in a meaningful analysis of the factors that really inform customers’ behaviors.

Using the tools and techniques of social science research, we often uncover a non-rational basis for key consumer decisions. In our team’s extensive experience, utility pales compared to instinct and emotion – drivers of the cognitive biases that prospect theory describes.

Below, we’ll explore three compelling cognitive phenomena that Tversky and Kahneman identified in their work and which we’ve observed in our own research on behalf of brands. In each case, we’ll indicate how this element of prospect theory could substantially improve your own brand’s strategy.

In many ways, the beauty of prospect theory is its broad relevance: Little is certain in life, so risks are integral to reality. To truly reach your customers, you’ll need to understand how they assess alternatives in an uncertain world.

Assessing Uncertainty: Three Key Prospect Theory Principles

1) Loss Aversion and Appetite for Risk

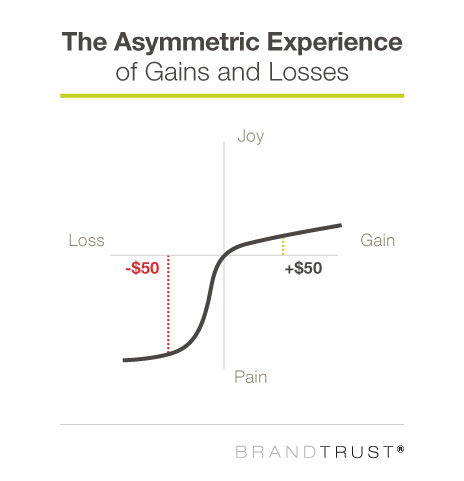

As the disease outbreak example suggests, individuals assess losses and gains in very different ways – even when they are numerically equivalent. Subjectively, humans experience the pains of losses to a greater degree than the joys of gains, and this emotional asymmetry powerfully impacts our inclinations.

“The response to losses is more extreme than the response to gains,” Tversky and Kahneman noted of their test subjects. “The displeasure associated with losing a sum of money is generally greater than the pleasure associated with winning the same amount, as is reflected in people’s reluctance to accept fair bets on a toss of a coin.”

Consider this scenario in your own life: If a friend bet you a dollar that a coin would come up heads, would you accept his or her wager? Tversky and Kahneman’s research suggests most of us would prefer to simply avoid such bets altogether instead. Losing a dollar will sting while winning one will bring only mild pleasure.

This dynamic promotes a conservative approach to risk assessment when alternatives are framed as potential gains. In the disease outbreak example, for instance, the certainty of saving 200 lives seems preferable. Within this framing, rolling the dice seems too risky: Sure, saving additional lives would be ideal, but saving no one would feel devastating.

But when options are framed in terms of losses instead, our tolerance of risk increases. Suddenly, we’re willing to take a long shot on saving all 600. The pain of a guaranteed loss of 400 lives is too great to accept, so people choose to preserve the possibility that they won’t lose any lives at all.

This phenomenon is well-known on Wall Street: Traders frequently suffer from the disposition effect, in which they sell winning stocks too early and hold onto losing stocks too long. Even as a stock continues to plunge in value, many traders will hold out hope that it will rebound – because accepting the emotional blow of the loss is just too difficult.

For brands, the implications of this principle are endless. Most obviously, companies typically urge consumers to act through incentives. Consumers are relentlessly subjected to gain-centric appeals, such as “Enroll in automatic billing to save 5 percent each year!”

But what if brands shifted their messaging to utilize the power of the loss frame instead, helping consumers form a different perspective of what is at stake? Consider this alternative to the message above: “We care about helping you save. Did you know that not enrolling in automatic billing could cost you over a hundred dollars a year? We can help you change that.”

2) Relative Assessment Effects

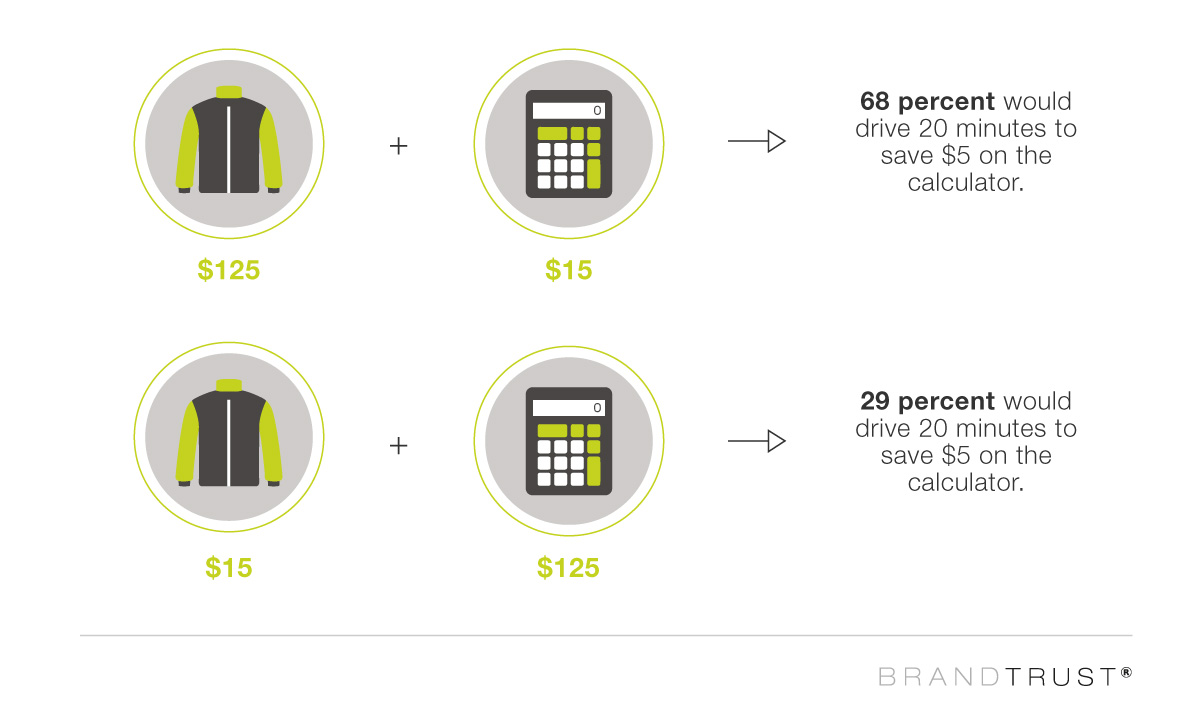

Imagine that you are buying a jacket ($125) and a calculator ($15). As you check out, the clerk at the register informs you that another branch, a 20-minute drive away, has the calculator on sale for just $10. Would you drive to the other store to get the lower price?

Tversky and Kahneman found that 68 percent of respondents would travel 20 minutes to save $5 on the calculator. They then altered the question in an interesting way, reversing the prices for each item. Now, the jacket cost $15 and the calculator cost $125. Faced with the same scenario of a sale at a nearby branch, only 29 percent of respondents would drive 20 minutes to buy the calculator for $120.

In both cases, the inconvenience and potential benefit are identical: You drive 20 minutes to save $5. Why would doing so be so much less attractive in the second case?

This example reveals a major limitation of utility-centric theories: According to traditional conceptions of marginal cost and benefit, respondents should respond in exactly the same way to both scenarios. Conversely, the prospect theory asserts that humans assess gains and losses in relative terms rather than absolute ones.

As Tversky and Kahneman noted, “Outcomes are expressed as positive or negative deviations (gains or losses) from a neutral reference outcome.” When the neutral reference outcome is paying $15 for a calculator, saving $5 seems like a substantial deviation for the positive. But when the reference point is paying $125, saving $5 seems like a tiny benefit instead.

This phenomenon relates directly to anchoring effects, or the way in which we assess value not in absolute terms but relative to a starting point. In negotiations, the initial offer sets the tone for subsequent discussions: If someone offers you $50 for an item, getting $60 feels like a win. Never mind that the item might actually be worth $75.

For brands, it’s important to consider the relative assessment effects in the context of discounts and charges. Imagine you offer a product for $100 and installation services for $25. Your company approves a $15 discount when customers buy both. Would you advertise a package discount from $125 to $110? Or would it be better to emphasize the price drop on the installation services specifically, highlighting a price drop from $25 to $10?

3) Certainty Effects

One might expect our comfort with risk to increase as probabilities rise: Our willingness to take a chance should increase as the odds of success improve from 50 percent to 60 percent. Additionally, our willingness should increase by an equal amount if the odds increase from 60 percent to 70 percent.

This linear progression is a basic tenet of probability-based games. In poker, for instance, we’re more likely to bet big if we have a flush than if we hold just a pair. But the prospect theory observes one instance in which this logical law crumbles: certainty.

A move from uncertainty to certainty produces emotional impacts unlike any other shift in probability. A change from a 40 percent probability to a 50 percent probability is much less attractive than a change from a 95 percent probability to a 100 percent probability – even though the probabilistic improvement is actually smaller in the latter instance.

Indeed, there’s something disproportionately powerful about the total certainty of avoiding bad outcomes; it’s why we buy insurance policies that protect against exceedingly unlikely events.

Similarly, a change from a 0 percent chance of winning to a 5 percent chance of winning is much more attractive than a shift from a 5 percent chance to a 10 percent chance. This phenomenon explains lottery sales: Although we’re extremely unlikely to win, buying a ticket is irrationally attractive because we’re not certain to lose either.

No brand should ignore the singular powers of certainty in trying to appeal to consumers. Suppose 95 percent of customers are satisfied with your product, and you’re eager to advertise that success rate. In the minds of consumers, however, the unsatisfied 5 percent could have an outsized negative impact: Satisfaction isn’t certain.

Thankfully, instilling certainty can be quite simple. Consider the comfort that the following statement provides: “If you’re unsatisfied for any reason, we’ll give you your money back, no questions asked.” That’s a 100 percent guarantee against wasted money and a powerful tool in easing customer anxiety.

Uncertainty in Innovation: Taking Risks to Transform Your Brand

Although we’ve described several ways brands might utilize these principles, we understand that implementation may pose significant challenges. Historically, companies have employed methods of logical persuasion to influence customer actions, from offering appealing sales to emphasizing beneficial product features. Just as the discipline of economics embraced prospect theory over a period of decades, organizations will not transform their marketing efforts to reflect these ideas overnight.

Still, complacency can only be counterproductive. Even modest attempts to incorporate behavioral economic learnings can benefit businesses of all sizes. Of course, stasis is tempting – especially if current strategies already seem to be working. If the prospect theory proves anything, it’s that we’re averse to jeopardizing current gains.

Yet, innovation requires a willingness to take positive risks in pursuit of growth and not just when losses loom large. If brands wait to experiment until they face real challenges, they may be too late to implement meaningful solutions. Indeed, the best approach is one of unceasing inquiry: How can we understand and serve our customers better?

Your team doesn’t need to undertake this journey alone. For nearly two decades, Brandtrust has helped brands navigate the world of brand strategy in all its excitement and uncertainty. Because our approach entails research techniques developed in the social sciences, you can proceed on the basis of real evidence rather than conventional wisdom.

From identifying relevant scientific learnings to uncovering findings specific to your brand, we’ll provide your company with the human truths that drive your customers. With the right information in hand, brand success becomes far more certain.

To learn how we’ve helped many of the world’s most respected brands understand their customers’ decisions, explore our body of past work here.